Controlling the timing of income and deductions. Contact your Human Resources department for information about your HRA plan design and qualified expenses.

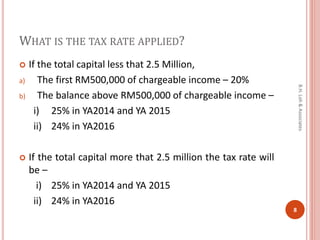

Corporate Income Tax In Malaysia Acclime Malaysia

Nearly all tax strategies use one or more of these strategies to structure transactions to obtain the lowest possible marginal tax rate.

. The tax invoice must also show. Do you need professional assistance and guidance on how to track and plan your taxes properly. If beaches aren.

Tax invoices sets out the information requirements for a tax invoice in more detail. And while advisors and clients have had a few years. This is significantly less than most insurance options at home.

Other expenses included in IRS Publication 502Medical and Dental Expenses as eligible or qualified expenses. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. Taxable and non-taxable sales.

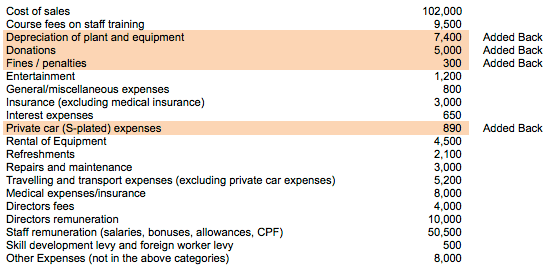

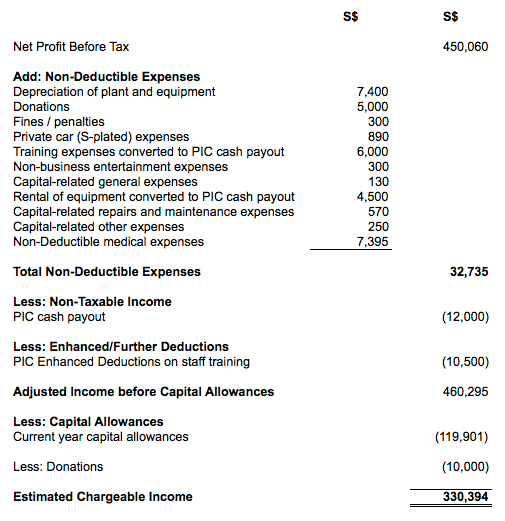

Research and development RD expense. As expenses are generally deductible from taxable income keeping proper track of them helps pay the right amount of taxes. Tax avoidance requires advance planning.

In general start-up expenses incurred before the commencement of a trade profession or business are capital in nature as they were expended to put the person in a position to earn income. A tax invoice that includes taxable and non-taxable items must clearly show which items are taxable. Effectively a deficiency withholding tax assessment will also result in a deficiency income tax exposure since the related deductible expense will also be disallowed.

Housing Costs in Malaysia. Assuming per trip is RM10000 and three times per year is RM30000 this RM30000 will be exempted and does not have to go in to your EA form. Organisational and start-up expenses are tax deductible fully in the first year of operation.

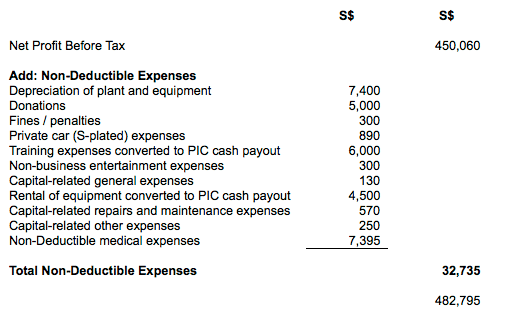

The tax base is affected by several other factors such as accounting policies exempt income special tax allowances or disallowances non-deductible or limited-deduction expenses losses brought forward etc. Cost of acquisition of goodwillamortisation of goodwill is not deductible as these expenses are capital in nature. Someone attempts to make too many claims of too many expenses as well as claiming non-business related expenses the auditor would ask.

Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers. NET OPERATING LOSS -- Amounts by which business expenses exceed income in a tax year. For RD expenses that have formed intangible assets the tax amortisation shall be based on 175 of.

As you plan to move one of the biggest factors you will consider is housing. Many countries levy income tax on this basis. From 1 January 2018 to 31 December 2023 175 of the eligible R.

NET INCOME -- Net income is gross income less deductible income-related expenses. Forecasting income and expenses is critically. The Tax Cuts and Jobs Act of 2017 commonly referred to as TCJA eliminated the deductibility of financial advisor fees from 2018 through 2025.

Different countries follow different accounting principles for tax purposes allow or disallow different deductions and grant different tax incentives and exemptions. The auditor will actually assess whether the expenses amount and nature of the expense booked by the company are reasonable and justifiable to be tax-deductible expenses. Many retirees choose to live in Penang an island state in northwest Malaysia.

Items are non-taxable if they are GST-free or input-taxed. So from the companys point of view its deductible. Generally tax incentives are available for tax resident companies.

GSTR 20131 Goods and services tax. A deductible is typically less than 70 and costs an average of 100 per month. This principle is based on Section 34K of the Tax Code which states that an expense will be allowed as a deduction for income tax purposes only if it is shown that the tax required to be deducted and.

Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10. Its under the so-called Staff Benefit and Amenity so its deductible for tax purposes for company accounting. Maximizing tax deductions and tax credits.

Risks of Over-claiming In the event of over-claiming ie. However there are specific. Generally the following expenses are qualified under an HRA plan.

A traders operating losses constitute broadly the excess of his operating expenditure over receipts from his operations.

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Tax And Secretarial Fee Tax Deduction Malaysia 2020 Dec 31 2020 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Your Complete Guide To Reimbursable Expenses Freshbooks Blog

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

The Pitfalls Of Interest Deduction Claims By Individual Taxpayers Acca Qualification Students Acca Global

Do You Need To Declare Your Rental Income To Lhdn

Do You Need To Declare Your Rental Income To Lhdn

Corporate Income Tax In Malaysia Acclime Malaysia

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Do You Need To Declare Your Rental Income To Lhdn

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Example Of Tax Deductible Entertainment Expenses Accounting Crash Course

Tax Planning Strategies Dignity Consultant

Tax On Limited Liability Partnership

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Ey Tax Alert Vol 25 No 1 10 January 2022 Malaysian Developments Income Tax Exemption And Income Studocu

Payroll Journal Entries For Wages Accountingcoach